The Australian Taxation Office (ATO) undertakes research to help them understand what people think about their services and products and the way they administer the tax and superannuation systems. They also statistically analyse the information you provide them on tax returns and other forms, and publish the result.

In this article, we have presented some key individual statistics available from the 2020-21 financial year. And here are the results !

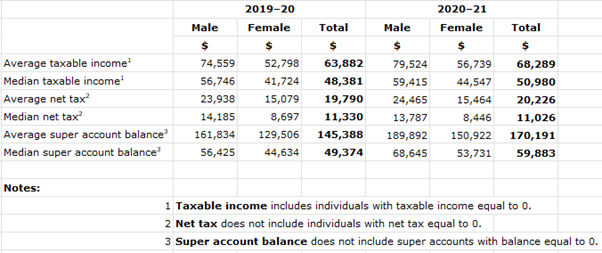

Average taxable income overall increased from $64k ti $68k from FY2020 to FY2021 with men earning more than women on average and also reported higher Superannuation balances as a result

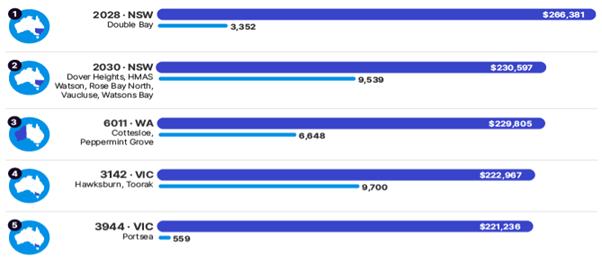

NSW’s eastern suburb residents continue reporting the highest taxable incomes in the country with some of the WA’s and VIC’s suburbs close behind.

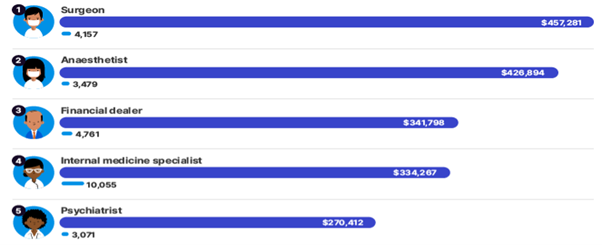

Medical professionals are the highest paid individuals with Surgeons topping the list and Anaesthetists next in line

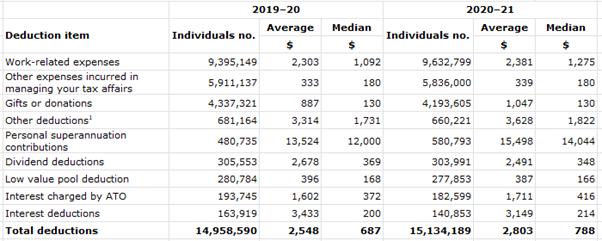

Other Work-related deductions was the most used category when it came to claiming deductions, but Personal Superannuation contributions tops the list in terms of $ value of an average deduction claimed.

ATO collect most of this tax voluntarily, reflecting a system that is operating well. The overall tax gap for 2019-20 is estimated to be $33.4 billion, or 7% of the tax that should have been reported. Latest tax gap estimates show that for 2019-20, ATO received $446.4 billion or 93% of the $479.8 billion which ATO would collect if everyone was fully compliant with tax law.

Written for you by Rohin Sharma

The information contained on this website and in this article is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. Taxation, legal and other matters referred to on this website and in this article are of a general nature only and are based on our interpretation of laws existing at the time and should not be relied upon in place of appropriate professional advice. Those laws may change from time to time.

View Comments